What are Balanced Advantage Funds

What are Balanced Advantage Funds?

Balanced Advantage Funds are a type of hybrid mutual funds which follow dynamic asset allocation strategy. Hybrid funds invest in multiple asset classes e.g. equity, debt, gold, real estate etc. As per SEBI’s mandate Balanced Advantage Funds can invest from 0 to 100% in equity and from 0 to 100% in debt as per their asset allocation model. The asset allocation of these funds can change depending on market conditions.

What is Asset Allocation?

Asset allocation refers to the strategy of diversifying your portfolio across different asset classes e.g. equity, debt etc. Different asset classes have different risk / return profiles. There is low or negative correlation of returns of different asset classes in different market conditions. The purpose of the asset allocation is to balance risk and returns.

Asset allocation strategies

- Strategic asset allocation: This asset allocation strategy is based on target allocations for different asset classes. Periodic rebalancing is required to bring the asset allocation back to the target. Hybrid schemes which follow strategic asset allocation usually have the flexibility of managing their asset allocation within ranges specified in the Scheme Information Document (SID) e.g. equity 65 – 80%, fixed income 20 – 35% etc. Fund managers stick to the target asset allocation ranges irrespective of market conditions.

- Dynamic asset allocation: In this asset allocation strategy, you continuously adjust your asset allocation mix depending on market conditions i.e. you will increase or decrease your allocations to equity and fixed income on an ongoing basis depending on market movements using a dynamic asset models which determine how much allocation you should have to equity and debt in different market conditions. The dynamic asset allocation models are back-tested to see how they perform in different market conditions and across investment cycles.

- Tactical asset allocation: Tactical asset allocation is a variant of strategic asset allocation strategy wherein the investor can occasionally deviate from the core strategic or dynamic asset allocation to take advantage of market opportunities. Tactical asset allocation involves market timing and requires considerable investment expertise.

Pros and Cons of Dynamic Asset Allocation

- Dynamic asset allocation has lower volatility and limited downside risks compared strategic asset allocation with high equity allocations.

- Advantage of systematic process driven approach versus discretionary decisions based on judgement calls or gut feelings.

- Potential of getting superior risk adjusted returns by making asset allocation decisions based on market conditions.

- Strategic asset allocation with high equity allocation tend to produce higher returns compared to dynamic asset allocation in bull markets.

Asset allocations in Balanced Advantage Funds

- Net or Active Equity: This is the un-hedged equity exposure of the fund. Net equity allocation is determined by a quantitative dynamic asset allocation model based on market conditions.

- Fixed Income: Fixed income allocation is determined by the asset allocation model but is usually capped at 35% to ensure equity taxation.

- Arbitrage: This is the fully hedged equity component which is not exposed to market risks but generates arbitrage (risk-free) profits based on price differences in cash and futures market or corporate actions. The arbitrage component reduces the net equity exposure and at the same time, helps to keep the gross equity exposure above 65%, which enables equity taxation.

Types of dynamic asset allocation models

There are broadly two kinds of dynamic asset allocation models– counter-cyclical and pro-cyclical.

- Counter-cyclical dynamic asset allocation: Counter-cyclical models increase equity allocation (reduce debt allocation) when equity valuations decline (become cheaper) and reduce equity allocations when valuations increase. It essentially follows the investment tenet of buying low and selling high. Different fund managers use different valuation metrics for dynamic asset allocation, the most common being P/E and P/B ratios. Some fund managers use multi-factor models which combine 2 or more factors e.g. P/E, P/B and Dividend Yield etc. Counter-cyclical dynamic asset allocation is the most popular model for Balanced Advantage Funds.

- Pro-cyclical dynamic asset allocation: Pro-cyclical models aim to capture the upside during the bull market and protect downside in bear markets. Funds employing pro-cyclical models increase their equity allocation in rising markets and reduce it in falling markets. Pro-cyclical models are based on market trend indicator (e.g. Daily Moving Averages) and indicators of the trend strength. Some pro-cyclical models may use other factors like market valuations and macro-economic factors.

Core and Tactical strategy

Many Balanced Advantage Funds follow a core and tactical portfolio strategy, combining dynamic asset allocation and aspects of tactical asset allocation strategies. The core portfolio follows the valuation based dynamic asset allocation model. The tactical strategy aims at boosting scheme returns in favourable market by taking tactical asset allocation calls based on trend indicators (e.g. Daily Moving Averages).

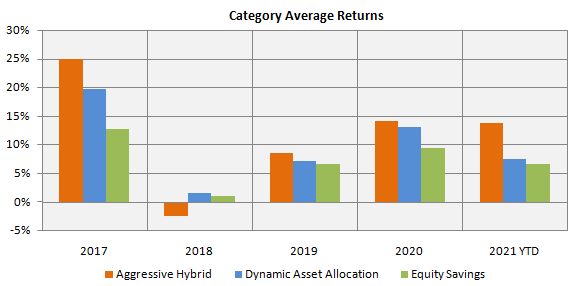

Balanced Advantage Funds versus other hybrid categories

Source: Advisorkhoj Research (as on 18th June 2021). Disclaimer: Past performance may or may not be sustained in the future.

Who should invest in Balanced Advantage Funds?

- Investors who are looking for capital appreciation and income over long investment horizons

- Investors who want lower downside risks in highly volatile markets

- Investors with moderately high risk appetites

- Investors with investment tenures of at least 3 to 5 years

- Investors should understand the dynamic asset allocation strategy, at least at a high level, before investing

- You should read the scheme information document and consult with your financial advisor if required

Article Source: Advisorkhoj.com

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully